The financial world is abuzz with talk of the first Presidential debate.

Meanwhile, one of the largest derivatives books in the world is imploding.

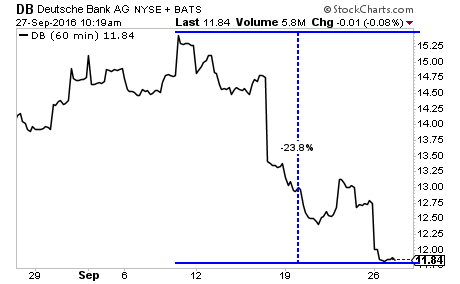

Deutsche Bank (DB) is the 11th largest bank in the world. And it has over $61 TRILLION (with a “T”) in derivatives on its books.

AND IT HAS LOST NEARLY A QUARTER OF ITS VALUE IN THE LAST THREE WEEKS.

DB is not alone here. Across the board, we’re getting signs of an impending banking crisis in Eurpoe.

The Single Best Options Trading Service on the Planet

Yesterday, while 99% of traders were getting killed we locked in THREE new double digit winners.

As a result of this, our options trading newsletter, THE CRISIS TRADER has now produced an astounding 270% return on invested capital thus far in 2016.

We have a success rate of 70% meaning we make money on SEVEN seven out of TEN trades. And thanks to careful risk management we’ve already produced a return on invested capital of over 270% thus far in 2016.

You can try this service for 30 days for just 99 cents.

To take out a $0.99, 30-day trial subscription to THE CRISIS TRADER…

CLICK HERE NOW!!!

———————————————————————–

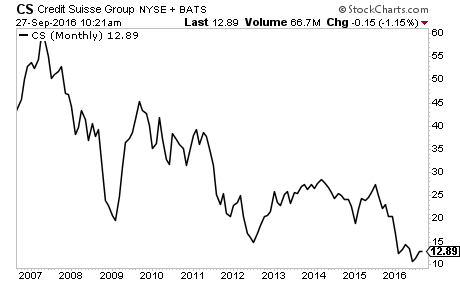

Credit Suisse (CS) is trading BELOW its 2012 banking crisis lows.

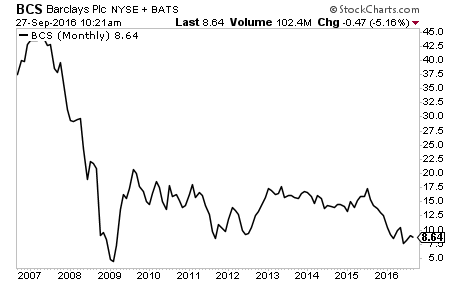

So is Barclays (BCS)

The EU banking system is $46 TRILLION in size. This is THREE TIMES larger than the US banking system, which nearly imploded the markets in 2008.

And the EU as a whole is leveraged at 26 to 1. Lehman Brothers was leveraged only slightly higher than this at 30 to 1.

A big move is coming to the markets. And we’re already preparing for it.

Κυριακή, 15 Δεκεμβρίου, 2024